Bitcoin Shakes Market Ahead of Big Crypto Week

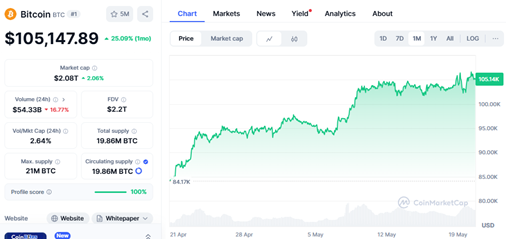

Bitcoin surged past $107,000 before quickly falling below $102,000 in a matter of hours, raising questions about the future direction of the world's largest cryptocurrency.

In a dramatic weekend, Bitcoin (BTC) surged to $107,000 — close to its record high of $109,000 set earlier this year. However, the rally was short-lived as BTC suddenly fell more than 4.7% in a matter of hours, falling to $102,000, its biggest one-day drop in over a month.

As of press time, Bitcoin is trading around $103,500, according to data from CoinMarketCap.

Strong volatility: The effect of cash flow and ETFs

This sudden price reversal is not entirely surprising to analysts, as the trading volume in the past 24 hours has skyrocketed by more than 80%, surpassing the $63 billion mark — an unusually high level, indicating that the market is very “hot”.

It is worth noting that the driving force of this increase does not come from traditional cryptocurrency traders, but from large inflows from traditional financial investors (TradFi), especially through US spot Bitcoin ETFs.

According to data from SoSoValue, in just the first three weeks of May, Bitcoin ETFs have absorbed a net of more than $3.35 billion, after receiving $3 billion at the end of April. In total, more than $6 billion has been injected into spot Bitcoin ETFs in less than a month — the highest level since January this year, when Donald Trump was sworn in as US President.

Large Institutions Accelerate Bitcoin Acquisition

Not only ETFs, large corporations such as MicroStrategy and Metaplanet also continue to increase BTC accumulation. According to 10x Research, these two companies have proactively sold overvalued stocks to convert into Bitcoin - a strategy that shows long-term confidence in the value of this digital asset.

Meanwhile, the macroeconomic context also plays a significant supporting role. The US Federal Reserve (FED) recently announced to keep interest rates in the range of 4.25% - 4.50% amid mixed signals from the economy.

Is this a healthy adjustment or a sign of deeper volatility?

According to some analysts, after a two-week hot surge, Bitcoin may enter a short-term accumulation or sideways phase. Analyst Astronomer believes that this could be a "cut-throat" phase before the market clearly determines its next direction.

On the technical charts, Bitcoin is showing some bearish divergence signals as the RSI is falling while the price is still trying to rise. However, the three-day time frame shows that an inverse head-and-shoulders pattern is forming – which is often considered a long-term bullish sign if the neckline is broken.

Currently, the important support zone of $97,000 – $98,500 is being viewed as a key “line of defense” that buyers need to defend to maintain the overall uptrend.

News to watch: Stablecoin regulatory framework is about to be passed

Another factor that could have a big impact on Bitcoin’s price in the near term is the regulatory landscape. The US Senate is set to vote on a bipartisan bill to establish a regulatory framework for stablecoins.

If passed, the bill could remove some of the ambiguity in digital asset regulation and pave the way for more institutional capital to enter the market — especially Bitcoin.

Conclusion: Volatility is Normal, Long-Term Trend Remains Positive

While Bitcoin may continue to correct or fluctuate in the short term, fundamental factors such as increased ETF inflows, institutional participation, and regulatory developments are all reinforcing a more positive long-term picture. Investors should closely monitor key technical milestones and macro information to make appropriate decisions during this sensitive period.