Jim Cramer Says Bitcoin Is on the verge of a real recovery – But is the Dip near?

.png)

As Bitcoin (BTC) breaks above $95,000 for the first time in two months, crypto analysts are quick to assess the sustainability of the rally. Jim Cramer — the controversial financial pundit who hosts CNBC’s Mad Money — has also weighed in on the state of Bitcoin and the broader financial markets.

Factors Driving the Recovery That Jim Cramer Mentions

According to Jim Cramer, positive developments in global trade negotiations, particularly with China, are emerging as a major catalyst for the current rally. Along with that, weak inflation data, falling crude oil prices, and expectations of a rate cut by the US Federal Reserve (Fed) are also adding momentum to the recovery of Bitcoin as well as large-cap altcoins.

As the Dow Jones Industrial Average soared 1,017 points, Jim Cramer emphasized that: "Breakthroughs like this are not simply due to a green light to buy."

He also noted that "FOMO" (Fear Of Missing Out) rallies are usually shorter-lived. However, with the current fundamentals, Cramer said that the market is building a stronger foundation. He compared the current situation to the Great Depression of 1932, noting that after the sharp crashes, the Dow Jones recovered for nearly a decade.

Bitcoin (BTC) Breaks Out of Traditional Markets

While the Dow Jones and stock indexes are recovering, Bitcoin appears to be on its own. As of press time, Bitcoin is trading around $93,641, hitting a new monthly high of $94,320.

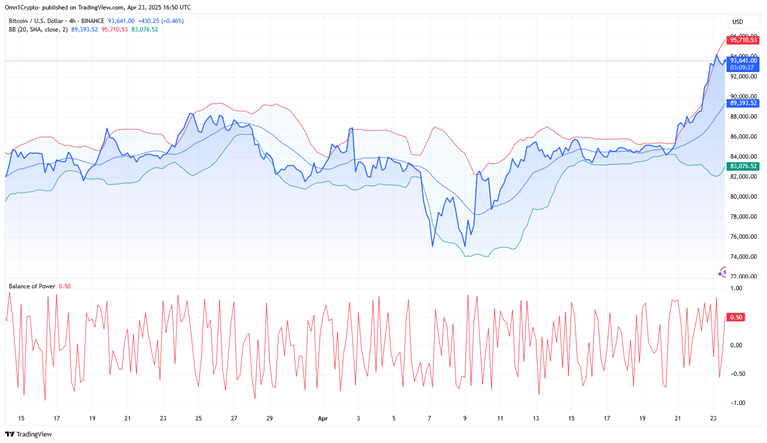

While still down about 14% from its all-time high of $108,786 set three months ago, Bitcoin is testing the red Bollinger Band (BOLL) line, located at $95,710.

Technical indicators reinforce bullish outlook

According to crypto analyst Ali Martinez, the Hourly Net Buyer Volume index has surpassed $62 million as Bitcoin surged 6.5% on the day. This suggests that buying power is strong enough to prevent major sell-offs, with the return of market whales.

The Chaikin Money Flow Index (CMF) is also rising, reaching 0.35 — a level that is similar to January 25, 2025, when BTC was $13,000 higher.

Data from CoinGlass shows that short sellers have been liquidated for a total of $232 million in the derivatives market over the past 24 hours, further strengthening the bulls’ position.

Things to note

While the current rally is positive, investors should be cautious. Comments from figures like Jim Cramer should be taken with a grain of salt, especially since Bitcoin’s price action is still influenced by a number of technical factors, social sentiment, and global geopolitical conditions.

Conclusion:

The Bitcoin market is entering an exciting phase, with the potential for a breakout or a sharp correction. While Jim Cramer is optimistic this time, as always, smart investors should do their own due diligence before making a decision.